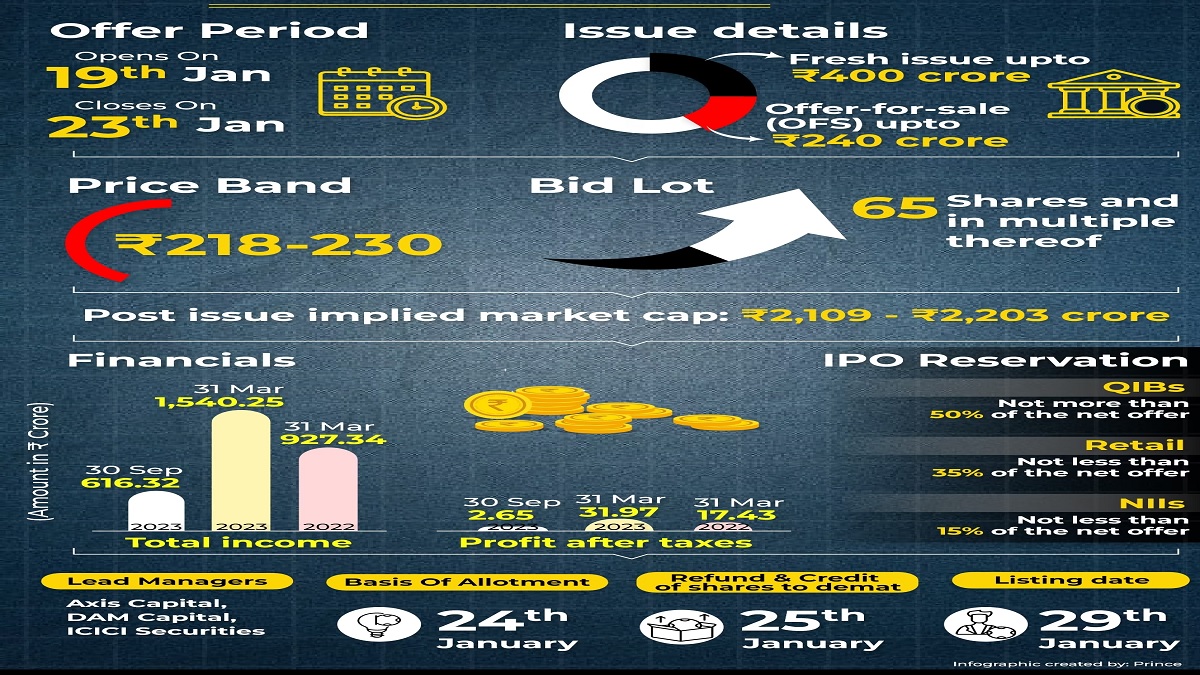

Attention investors! The much-awaited Epack Durables IPO is here, offering shares at an attractive price range of Rs. 218-Rs. 230. This issue boasts a whopping Rs 400 crore equity issue and a 1.04 crore share offer for sale (OFS). With an expected IPO raise of Rs 640 crore, this company, renowned as India’s second-largest ODM of room air conditioners, aims to clear its debt and bolster its capital expansion goals. Exciting times are ahead for this business, with a diverse range of products that include components, small household appliances, and room air conditioners. Be with this article to learn more about this IPO.

Don’t miss your chance to invest in the highly anticipated Initial Public Offering (IPO) of Epack Durables. The company is issuing a total of Rs 400 crore in new equity, along with an offer for sale (OFS) of 1.04 crore shares. This offer will only be available until January 23, so act fast. By participating in this IPO, you will be contributing to the company’s goal of raising approximately Rs 640 crore. As proof of its success, Epack Durable was ranked the second-largest original design manufacturer (ODM) of room air conditioners in India based on unit sales in FY23. Swipe down if you don’t want to miss any minor details.

Epack Durable stands as a leader in the market for designers and manufacturers of room air conditioners, small household appliances, and components. With a wide range of impressive products, this is an opportunity not to be missed in contributing to our company’s growth and success. Boasting cutting-edge vertical integration in manufacturing, strong product development capabilities, and solid partnerships with esteemed clients, we are poised for continued success. The proceeds from our upcoming IPO will fund strategic expansion plans and chip away at our outstanding debt. Keep reading for more information.

Our success in maintaining stable financial performance can be attributed to our unwavering dedication to broadening our range of products. According to Arihant Capital, the upper band valuation of the IPO stands at a 20.2x EV/EBITDA and 51.4x PE based on FY23 EBITDA and EPS of Rs 4.5. Echoing this sentiment, BP Equities also advises investing in the IPO, citing various positive factors such as rising global temperatures, increased consumer purchasing power, government support, urbanization, and higher domestic demand for RACs, all of which will benefit the company in the years to come. Let’s be with this article through the end.

Investors have the opportunity to acquire 65 shares in a single lot at a fixed price range of Rs 218–230 per share, with a significant portion of the offer reserved for qualified institutional buyers, retail investors, and non-institutional investors. The company has demonstrated strong growth in revenue, EBITDA, and PAT with a CAGR of 44.6%, 56.2%, and 102.5% respectively during the FY21–23 period. Impressively, the company achieved a revenue of Rs 615 crore and a net profit of Rs 2.6 crore in the six months ending September 2023. In the same period, the company’s operating revenue and profits recorded remarkable increases of 66% (to Rs 1,539 crore) and 88% (to Rs 32 crore) respectively. Continue not to miss anything.

This offering is in good hands with Axis Capital, DAM Capital Advisors, and ICICI Securities on board as the book-running lead managers. This business is a major player in the RAC market, known for its production of cutting-edge ODM products and accompanying services. In addition, it has completed backward integration for home appliances. While the first half of FY24 saw a slight decrease in both top and bottom lines, this is in line with the overall industry trends after three consecutive years of growth. Be with the article for more details.

In 2003, the company first emerged in the bustling city of Dehradun, Uttarakhand, with just one manufacturing facility. As time passed, they expanded their reach and capabilities by establishing Dehradun Units II, III, and IV, as well as Bhiwadi and Sri City Manufacturing Facilities. Today, their impressive client list includes renowned names such as Blue Star, Carrier Midea, Havells India, Haier Appliances (India), Panasonic Life Solutions India, Godrej and Boyce Manufacturing Company, Bajaj Electricals, and Daikin Airconditioning India. Let’s look over the entire article in detail if you want to get all the information about it.

EPACK Durable holds the distinction of being India’s second-largest RAC ODM. But, to make an informed investment decision, some important considerations must be taken into account. One of which is the business’s dependence on a select few key clients. Moreover, the RAC sector is highly competitive, and the company also faces seasonal fluctuations in its operations. With expert insight, analysts at Swastika Investment recommend potential investors to carefully consider this IPO from a medium- to long-term perspective. Furthermore, the company plans on introducing new products into its appliances portfolio. Stay connected for any latest news updates on our website.